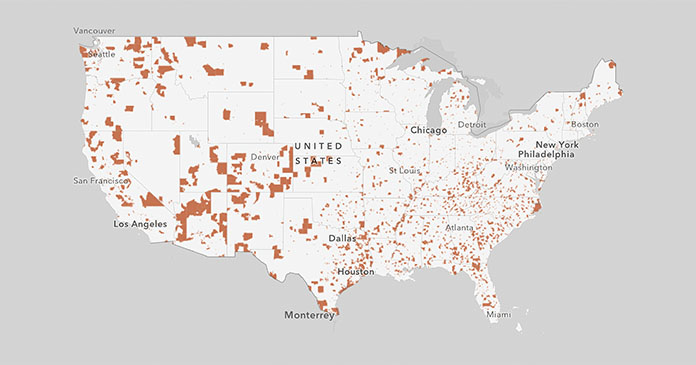

Qualified opportunity zones (QOZs) are communities that have an average poverty rate at or above 12.5 percent over the past 3 years and have not been subject to any community benefit program during that same time frame. QOZs were designated by the Internal Revenue Service (IRS) and set up by the Tax Cuts and Jobs Act of 2017 as a way to spur investment in these underdeveloped areas, with an emphasis on rural and distressed communities. With the passage of the Tax Cuts and Jobs Act (TCJA), Congress created 8,700 QOZs across the country.

These opportunity zones were designed to create economic opportunity in certain low-income communities that have not been traditionally attractive for investment. By creating incentives for investment in these areas, it is expected that communities will be revitalized, creating more business opportunities and, by extension, jobs. You can invest in a qualified opportunity zone by purchasing qualified opportunity zone property, investing in a QOZ Qualified Opportunity Fund, or making an eligible deferred compensation contribution to a QOZ Deferral Account.

By investing in a QOZ, investors may defer paying taxes on capital gains if they hold their investment for a minimum of five years. For example, if an investor holds their investment in a QOZ for a minimum of five years their amount of investment will increase by 10% of the deferred gain. If the investment is held for a minimum of seven years their deferred gain will increase by an additional 5%. The main attraction though, is if an investor holds their investment for a minimum of 10 years, the investor may be able to permanently exclude gain.

QOZs gives investors ample time to reinvest their money and potentially grow it even more. It is important to note that these benefits apply only to investments made after December 31st, 2017 and before December 31st, 2026. Between the investor tax benefits and the positive impact these QOZs can potentially have on ESG, Paradyme decided to add two new projects that are a part of a Qualified Opportunity Fund. This is a great opportunity to diversify an investment portfolio while also supporting communities in need of financial help. If you would like more information on these investment opportunities please click below.