Our mission is to provide access to highly vetted, diverse real estate investment opportunities with transparency, education and ease.

What We Do

Paradyme is a vertically integrated Venture Capital & Real Estate Investment Firm.

A state-of-the-art crowdfunding platform, investment management software, and a Family Office Networking strategy make up the foundation of our business model. Paradyme uses its proprietary business strategy and software to successfully syndicate debt & equity for real estate developments.

Paradyme focuses on two aspects. First, to close the gap of the housing crisis/demand with affordable single family & multifamily assets. Secondly, add value to the local economy with lifestyle-centric developments that organically bring together the residents of a community for recreation, sporting, entertainment and more. Paradyme believes in, utilizes, and caters to health and wellness, ESG, and technology in all aspects of the business and our developments.

The Paradyme Difference

Paradyme is more than just your average investment firm.

Our team is available at your request. We have a hands-on policy to provide our time and share our knowledge about the investment opportunities, the investment process, and will do so for the life of your investments with us.

Paradyme furthers the reach of our investors by providing opportunities across the nation, in thriving markets, with deep data strategy at the forefront of our decision to present deals.

We provide a comprehensive approach to real estate investing with full access to our platform of diverse deals, ease of investing, and thorough integration into our family of investors.

Current Investor Testimonial

“If there was one word to describe Paradyme, I would say it’s ‘transparent’. That’s what I’ve been most impressed with – they pull back the curtain and show me everything that the investments are about.”

Rusty F.

Performance Numbers for Paradyme

We continue our proven track record of strategic vetting by providing diverse, opportunistic investments for those looking to strengthen their portfolios through alternative investments such as real estate.

300

1000

1

18

Invest Into Debt

Invest Into Equity

Who we work with:

Accredited Investor

An accredited investor is anyone making at least $200,000 annually (at least 300,000 including a spouse) OR has a total net worth of more than $1 million when their primary residence is excluded.

Non-Accredited Investor

A non-accredited investor is anyone making less than $200,000 annually (less than $300,000 including a spouse) that also has a total net worth of less than $1 million when their primary residence is excluded.

Investment Opportunities

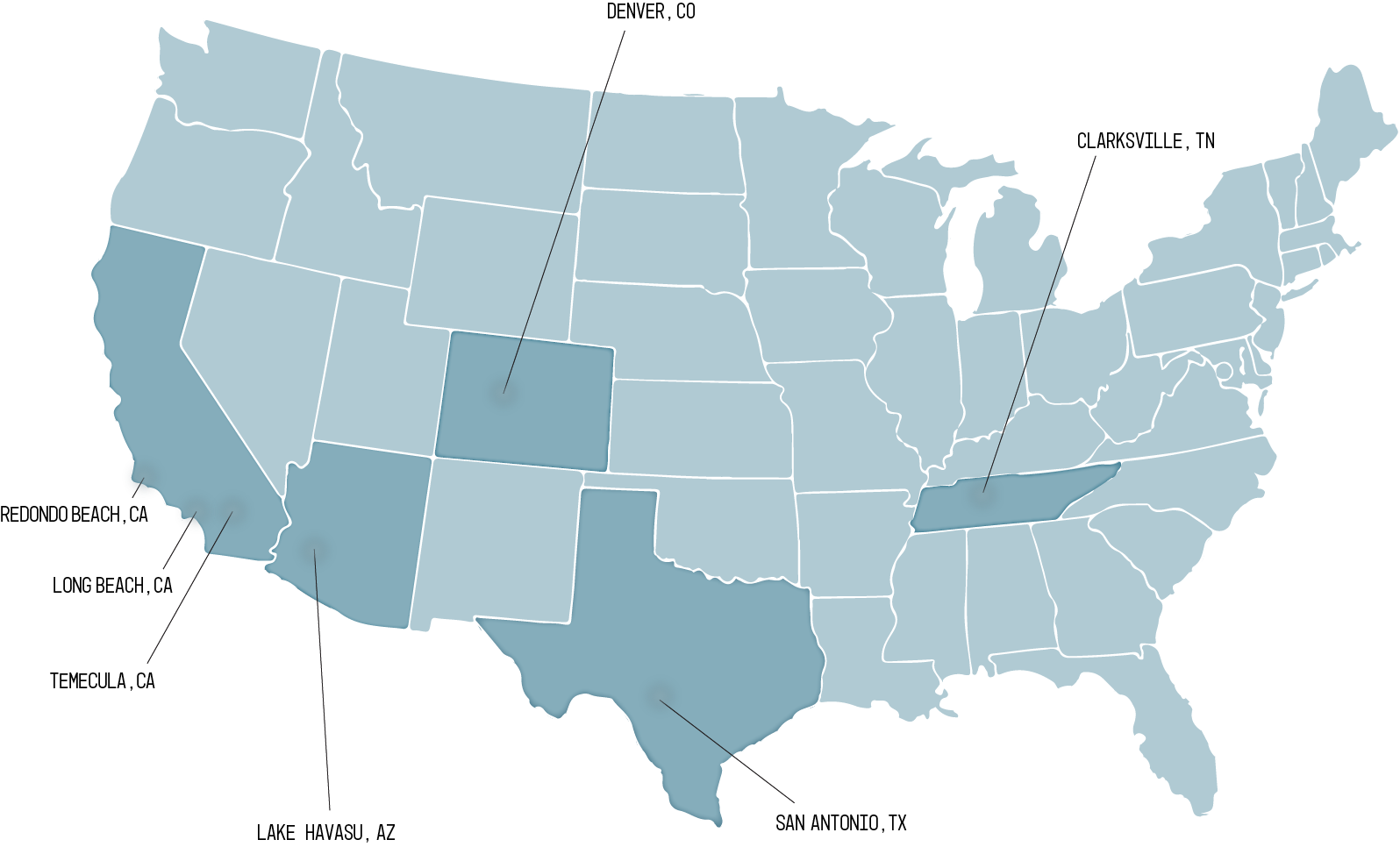

Current Project Locations

- Long Beach, CA – Qualified Opportunity Zone Projects Offered to Investors. By presenting our investors with opportunities in a QOZ you can discover how to defer and reduce your taxes. Ideal for capital gains and 1031 exchange.

- Redondo Beach, CA – The Redondo Beach Pier is undergoing a $300M re-gentrification project called “The Waterfront”. This will provide a lifestyle-centric, “Live, Work, Play” atmosphere in the city for it’s residents. Housing in this area is in high demand due to low supply of land for development.

- Lake Havasu, AZ – Lake Havasu City, AZ continues to see explosive growth in both permanent residents and seasonal visitors. The Lake Havasu Tourism Bureau estimates 1.5M people visit Lake Havasu City each year. The current population growth rate is 1.49% annually and continues to climb. Havasu has always been a destination for boaters, campers, and water sports enthusiasts, and as the tourism grows, there is a massive demand for storage facilities, which have always been almost impossible to find.

- Clarksville, TN – Recent Study: Clarksville shows ninth-most economic growth among small U.S. metros. A recent National Association of Realtors report shows that while the Nashville-Davidson-Murfreesboro-Franklin metro area is one of the largest growing markets in the country, it is Clarksville that ranks as the fifth-fastest growing housing market in the U.S. Money Magazine called Clarksville the “Best Place to Live Right Now”.

- Denver, CO – Strong population growth drives Denver into top 10 metros for new construction. A January study by CBRE (NYSE: CBRE) also found that Denver’s office market was bouncing back from the pandemic faster than in many other large U.S. cities.

- San Antonio, TX – San Antonio lands in top 10 of U.S. cities with most population growth. Among the country’s 50 largest metro areas, San Antonio landed at No. 7 (19.4 percent) in terms of population growth in a 10-year period.