THE FUND SUMMARY

16%

PROJECTED IRR

2.4x

PROJECTED EQUITY MULTIPLE

5 Years

Term

$50,000

Minimum Investment

Pref Return/ Upside

Paid Quarterly

$11.3 Million

LP Equity

Accredited

Investors

Property at a Glance

# of units

30

Est. Construction Completion Date

July 2024

Estimated Stabilization Date

March 2025

Avg. Unit Size

1,676 SF

Residential Rent Per Unit

$8,096

Exit Cap Rate

4.5%

Investment Highlights

Strong Return Portfolio for High-Demand Los Angeles Beach Cities - 2.4x EM in 5 Year

The Investment is projected to yield 11.07% + annual cash on cash to investors with a total 16% (net) Investor Level IRR and 2.4x (net) Equity Multiple over a five-year hold. For example, a $100,000 investment is projected to return a total of $240,000 to you over the next 5 years. As an illustration of the cash flow timeline, a $100,000 investment is projected to return $20,000 in 30 months, $3,000 each quarter thereafter, and $190,000 at sale.

Streamlined Approval Process for Building Approval & Permits

Beach City Capital closely worked with the City of Redondo Beach for 36 months to design a program that has the full support of City staff, and in October, 2021 Beach City Capital re-submitted the Project’s complete entitlement application to the City’s Planning Development. We expect to get planning entitlements by the end of Q1 2022 and start construction in Q4 2022.

Mitigated Development Risk & Completion Certainty

Construction is on schedule to commence Q4 2022. Investors will be protected by a Guaranteed Maximum Price (GMP) construction contract for any potential construction cost increases, and we will use construction bonding to ensure the Project is completed. We have also invested extensive time working with multiple GC’s, sub-contractors, and the City to create accurate cost estimates and will implement Building Information Modeling (BIM) software to save additional cost and time. Given our efforts during this pre-development phase, we expect a maximum 20-month construction period.

Affordable & Efficient Living with Modern Suites Designed for Roomates

As our primary business plan, we have contracted with Common, Los Angeles’ market leading, roommate centric property manager to brand, market, and operate the Project’s residential townhomes with flexible leasing options. The Project’s 30 residential units will feature 22 fully furnished townhomes, and 8 traditional rental apartment units. 15% of the unites are dedicated as affordable for very low-income residents. An overview of Common is provided on the following page.

High-Demand Location in Coastal Los Angeles, CA

Catalina Village is located directly across the water at 100-132 N Catalina Ave in South Redondo Beach, CA with a public ocean-view park directly across the street and a variety of restaurants, beaches, and outdoor activities within walking distance. The area continues its rapid expansion, and the widespread diversification in recent years has produced a large amount of professional and business services, firms, and corporate headquarters in the Los Angeles South Bay area. Local rents are about $4 PSF and cap rates are in the mid 3% range.

Investment Process

Review the Investment Memorandum, webinar, and the Legal Documents (Subscription Agreement and PPM) and start your personal due diligence. We’ll respond and will provide support for your due diligence for 10 days. When you’re ready, you can execute the documents within your Online Investor Portal, and you’ll receive wiring instructions. Your investment starts to earn your Preferred Return the day of investment and you will receive quarterly reports throughout the Project’s lifestyle. The first payment to you will be at the construction loan refinance and then every quarter thereafter until the project sale.

Project Summary

Project Summary

Project Name

Catalina Village - Redondo Beach

Address

100 N Catalina Avenue, 90277

Lot Size SF

55,000

Residential Rentable SF

50,269

Commercial Rentable SF

5,369

Total Rentable SF

55,638

# of Bed / Units / Avg Unit Size

132 Beds | 30 Units |1,676 SF

Residential Rent per Bed / Unit / SF

$1,840/Bed |$8,096/Unit | $4.83/SF

Commercial Rent per SF

$3.12/SF

Total Parking Residential / Commercial

67/11

Project Schedule

Project Summary

PROJECT SCHEDULE

Land Control

12/31/2018

Land Acquisition

5/31/2022

Est. Construction Starts

3/2/2023

Est. Construction Completion

7/31/2024

Est. Stabilization

3/15/2025

TOTAL PROJECT LENGTH

74 Months

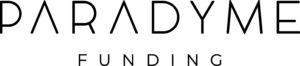

Financials

Financials

LAND ACQUISITIONS

Land Purchase

$12,750,000

Acquisition Loan

$11,000,000

Mezzanine Loan (Temp.)

$400,000

New LP's

$4,682,698

GP Fund

$1,350,856

Land Extension Options

$750,000

Hard Costs

-

Soft Costs

$2,691,643

Site Remediation

$170,646

Common FF&E

-

Closing Costs

$270,000

Land Interest Reserve

$916,667

Development Fee

$634,598

Project Contingency

-

Total

$17,433,554

CONSTRUCTION START

Construction Loan

$28,000,000

Mezzanine Loan

-

New LP Equity

$6,997,044

Land Purchase

-

Land Extension Options

-

Hard Costs

$14,281,287

Soft Costs

$474,996

Site Remediation

$511,938

Common FF&E

$849,400

Guarantee Fee

$288,000

Closing Costs

$576,000

Mezzanine Loans (Other Retail) Interest

$252,258

Land Interest Reserve

-

Construction Interest Reserve

$5,147,481

Development Fee

$634,598

Project Contingency

$948,995

Project Formation

$369,855

Equity Reserve

$62,236

Total

$35,797,044

REFINANCE SENIOR LOAN

Loan Amount

$33,700,000

Loan to Value (LTV)

65%

Debt Yield

7.50%

Rate

3.75%

Amortization

30 Years

Term

10 Years

Loan Fee

2.00%

Footnotes

1 Stipulated Sum Contract in-place for site remediation

2 Development Management fee is billed with a 30% deposit and then billed on a straight-lined monthly basis thereafter with 85% reserved for Pre-Development and 15% for Construction period

3 Guarantee Fee for Construction and other GP requirements

4 Closing Costs: Assumes 2 points origination and 1 point broker fee plus $50,000 of DD

5 Construction Interest Reserve: Assumes interest rate is paid from an upfront reserve for the period of construction and stabilization

6 Project Formation costs include placement fees for equity syndication, LP procurement, and structuring costs, both in-house and to third parties

7 Equity Reserve to facilitate construction loan draws and is expected to be returned to investors at refinance

Distributions

Distributions

RETURN: 3-YR DEVELOPMENT PHASE

Return on Cost (Untrended)

5.56%

Return on Cost (Stabilized)

6.17%

Residential Exit Cap Rat

4.50%

Commercial Exit Cap Rat

6.00%

Cost of Sale

2.00%

Overall Exit Price

$51,769,994

Exit Price (Residential)

$47,349,695

Exit Price/Unit

$1,578,323

Exit Price/Bedroom

$358,710

Exit Price/RSF

$942

Exit Price (Commercial)

$4,420,299

Exit Price/RSF (Commercial)

$823

Levered Project IRR

25.56%

Project Equity Multiple

1.77x

Total Project Profit

$9,707,190

RETURN: 5-YEAR HOLD

Exit Cap Rate

4.50%

Levered Project IRR

18.09%

Project Equity Multiple

2.69x

Average Cash on Cash Return

11.07%

Total Project Profit

$21,428,622

RETURN: 10-YEAR HOLD

Exit Cap Rate

4.50%

Levered Project IRR

17.00%

Project Equity Multiple

4.24x

Average Cash-on-Cash Return

8.12%

Total Project Profit

$41,012,004

Beach City Capital

We are a Los Angeles based multifamily developer focused on delivering mid-market, attainable housing solutions in Southern California’s high-demand coastal neighborhoods.

Beach City Capital is a private Real Estate Investment Firm headquartered in Hermosa Beach, California. Beach City Capital focuses on executing the development and/or repositioning of multifamily and commercial assets targeting value-add/ opportunistic returns. Our investment approach capitalizes on a broad platform, utilizing in-house Real Estate professionals whose expertise spans all phases of the Real Estate life cycle.

Our in-house staff is composed of experienced professionals in Land Use, Financial Underwriting, Architecture, Development, and Real Estate Markets – all seasoned to pursue a consistent, disciplined investment process that combines local market knowledge and hands- on expertise to created added value for our shareholders.

Each project is crafted with pristine excellence and perfection, with the goal to created spaces which modernize and inspire everyday life. We prioritize enhancing the urban fabric of the city and in doing so, our projects must be affordable, well-integrated, and positively impactful.

Location

Land Use & Design

Redondo Beach Zoning

Total Site Land Area: 55,000 SF

Historical Use Preservation: The existing 25,350 SF will be reduced and adaptively reused to 3,000 SF of neighborhood retail space, a 2,400 SF public/ private courtyard, and four large multifamily buildings. Renovations will modernize the existing historic buildings while celebrating the history of the site. The commercial uses will include a coffee/sandwich shop and micro-brewery tasting that will open to a central courtyard facing Catalina Ave. The existing two-story Lodge building will be converted into a primary residential amenity space and four private residential units.

State Affordable Housing Program (SB 1818): The Project’s existing R-3A Zoning Density allows for 22 units by-right (55,000 SF / 2,490 SF/DU =22). Through State Bill 1818, we are reserving 15% of the residential units for Very-Low Income housing to benefit from a 35% density bonus to yield a total of 30 allowable dwelling units (22 x 1.35 = 30) along with 3 incentives to support developmental requirements.

Entitlement Strategy

Planning Approval: After extensive review with the City’s planning staff, the project is scheduled to secure planning entitlements by the end of Q1 2022. Key entitlements include: Planning Commission, Historical Preservation, and the City Council.

Permit Approval: The sponsor will begin producing Construction Documents prior to official Planning Approval so that Building Permits will be received, and construction will commence at the end of Q4 2022.

Environmental Strategy

Phase I and Phase II Environmental Reports confirmed low levels of PCE and arsenic remediation needed from the site’s previous dry cleaner and railroad line activity. The scope of the remediation is limited to the top five feet, which was expected. The Sponsor negotiated with the landowners to reduce the purchase price and worked with environmental consultants and estimators to set a site strategy in motion to remediate the site with minimal risk exposure.

The Sponsor has contracted with E2C Remediation and secured a Stipulated Sum contract for the entirety of the remediation. Remediation will include excavation of the arsenic and vapor extraction of the PCE with the first two feet, which will take 16 months and provide the project a 10-month window of contingency to receive our letter of No Further Action from LA County Fire. This aligns with the project schedule prior to the final certificate of occupancy.

The Remediation Strategy & Application has been reviewed and approved by the Los Angeles Fire Department and is now active.

Track Record

Disclosures

Catalina Village Disclosures

Neither Beach City Capital Management, LLC (the “Manager”) nor Catalina Entitlement Fund, LLC (the “Company”) is registered as an investment adviser with the Securities and Exchange Commission (“SEC”) or any State’s securities commission. The units (the “Units”) in the Company and Catalina Entitlement Fund, LLC (the “Entitlement Fund”) are offered under a separate private offering memorandum (the “Offering Memorandum”), have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), or any State’s securities laws, and are sold for investment only pursuant to an exemption from registration with the SEC and in compliance with any applicable state or other securities laws. Units are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under the Securities Act and applicable state securities laws. Investors should be aware that they could be required to bear the financial risks of this investment for an indefinite period of time.

THE INFORMATION FURNISHED IN THIS MARKETING CIRCULAR IS IN ALL RESPECTS CONFIDENTIAL IN NATURE. DISSEMINATION OF THIS CIRCULAR OR DISCLOSURE OF ANY KIND MAY CAUSE SERIOUS HARM OR DAMAGE TO THE COMPANY, ENTITLEMENT FUND AND THE MANAGER. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

A prospective investor should only commit to an investment in the Company/Entitlement Fund if such prospective investor understands the nature of the investment and can bear the economic risk of such investment. The Company/Entitlement Fund is speculative and involves a high degree of risk. The Company/Entitlement Fund may lack diversification, thereby increasing the risk of loss. There can be no guarantee that the Company/Entitlement Fund’s investment objectives will be achieved. The Company/Entitlement Fund’s investments are expected to be illiquid and involve a high degree of business and financial risk that could result in substantial losses. Because of the absence of a secondary market for these illiquid investments, and because of the difficulties in determining market values accurately, it may take the Company/Entitlement Fund longer to liquidate these positions (if they can be liquidated) than would be the case for more liquid investments. The prices realized on the resale of illiquid investments could be less than those originally paid by the Company/Entitlement Fund. As a result, an investor could lose all or a substantial amount of its investment. In addition, the Company/Entitlement Fund’s fees and expenses may offset its profits. There are restrictions on withdrawing and transferring interests from the Company/Entitlement Fund. In making an investment decision, you must rely on your own examination of the Company/Entitlement Fund and the terms of the prospectus. The information herein is not intended to provide, and should not be relied upon for, accounting, legal, or tax advice or investment recommendations. You should consult your tax, legal, accounting, or other advisors about the matters discussed herein. The Company/Entitlement Fund’s ability to achieve its investment objectives may be affected by a variety of risks not discussed herein. Please refer to the Offering Memorandum for additional information regarding risks and conflicts of interest.

No representations or warranties of any kind are made or intended, and none should be inferred, with respect to the economic return or the tax consequences from an investment in the Company/Entitlement Fund. No assurance can be given that existing laws will not be changed or interpreted adversely. Prospective investors are not to construe this presentation as legal or tax advice. Each investor should consult his or its own counsel and accountant for advice concerning the various legal, tax, ERISA and economic matters concerning his or its investment.

No person other than the Manager has been authorized to make representations, or give any information, with respect to the Units, except the information contained herein, and any information or representation not expressly contained herein or otherwise supplied by the manager in writing must not be relied upon as having been authorized by the company or any of its members. Any further distribution or reproduction of this memorandum, in whole or in part, or the divulgence of any of its contents, is prohibited.

This presentation is being furnished to you on a confidential basis to provide preliminary summary information regarding an investment in the Company/Entitlement Fund managed by the Manager and may not be used for any other purpose. Any reproduction or distribution of this presentation or accompanying materials, if any, in whole or in part, or the divulgence of any of its contents is prohibited. The information set forth herein does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. It is meant to be read in conjunction with the Entitlement Fund’s Offering Memorandum prepared in connection herewith, and does not constitute an offer to sell, or a solicitation of an offer to buy, by anyone in any jurisdiction in which such an offer or solicitation is not authorized or in which the making of such an offer or solicitation would be unlawful. The information contained herein does not purport to contain all of the information that may be required to evaluate an investment in the Company/Entitlement Fund. The information herein is qualified in its entirety by reference to the Offering Memorandum, including, without limitation, the risk factors therein.

An investment in the Company/Entitlement Fund has not been approved by any U.S. federal or state securities commission or any other governmental or regulatory authority. Furthermore, the foregoing authorities have not passed upon the accuracy, or determined the adequacy, of this document, the Offering Memorandum or Operating Agreement associated with the Company/Entitlement Fund. Any representation to the contrary is unlawful. Certain information contained in this document constitutes “forward-looking statements” which can be identified by use of forward- looking terminology such as “may,” “will,” “target,” “should,” “expect,” “attempt,” “anticipate,” “project,” “estimate,” “intend,” “seek,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to the various risks and uncertainties, actual events or results in the actual performance of the Company/Entitlement Fund may differ materially from those reflected or contemplated in such forward-looking statements.