PROJECT SUMMARY

17%

PROJECTED IRR

$50,000

Min. Investment

3 Years

Term

Accredited

Investors

The Woods at McCormick Townhomes

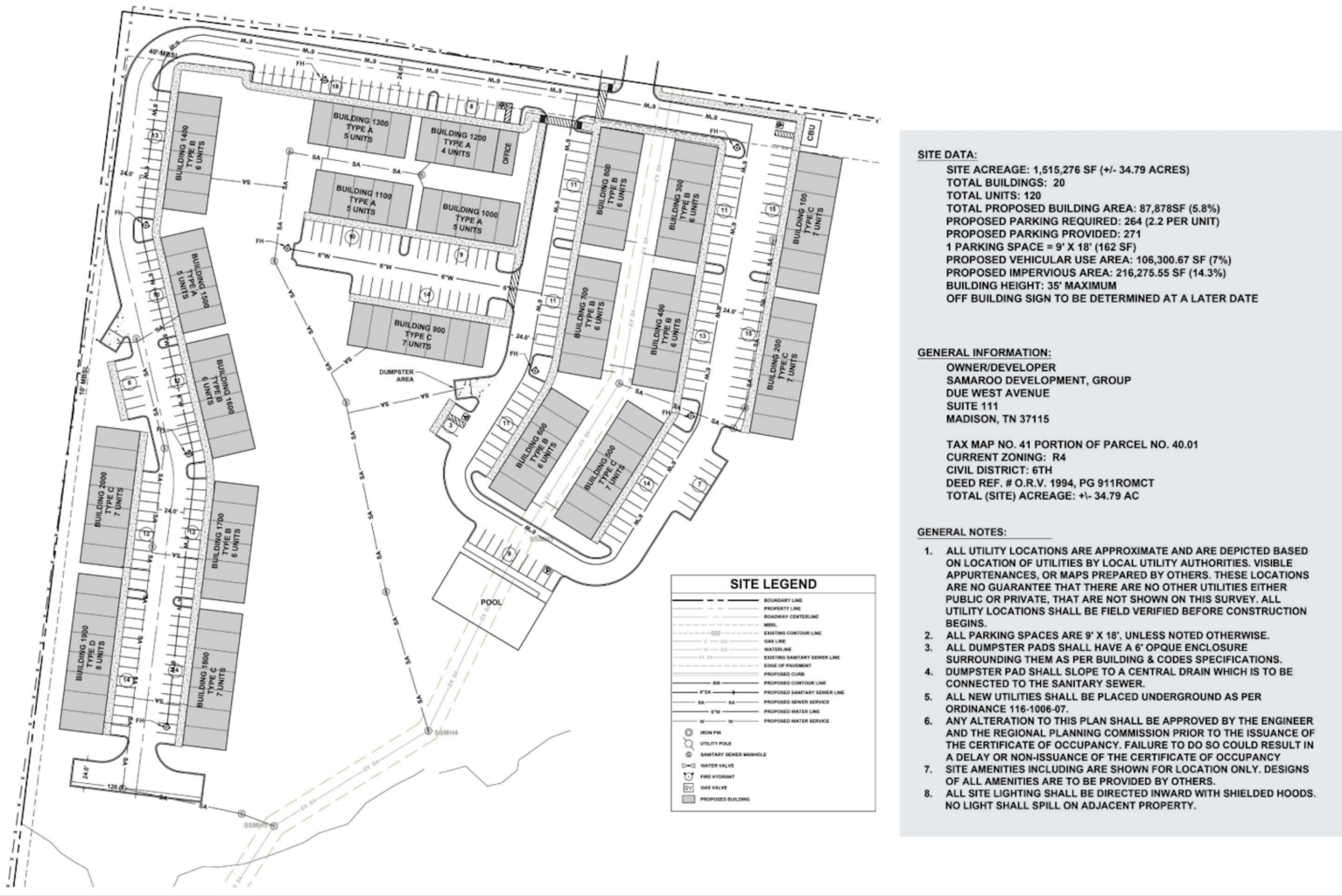

The Woods at McCormick is a 120-unit Build-To-Rent sub-urban complex in a neighborhood currently experiencing high growth and renewal. The Woods is located on a 15-acre wooded lot conveniently off of Tracy Lane highway. This two floor, 120,000 square foot residential project will offer 100% market-rate units in 21 buildings.

The community will be the only one on the market equipped with a leasing office and community center, walking and hiking trails, a private dog run and bathing station, and swimming pool. The community is situated immediately within five minutes from the recently constructed Publix grocery store and shopping center.

SEE HOW MUCH YOUR INVESTMENT CAN EARN YOU

PROPERTY AT A GLANCE

Location Highlights

Clarksville Ranks No. 1 Hottest Housing Market Nationwide

Clarksville Ranks No. 1 Hottest Housing Market Nationwide in Opendoor Study!

Opendoor’s study used Multiple Listing Service (MLS) data to rank the top 10 U.S. neighborhoods by total homes contracted within 90 days of being listed. Clarksville took the top spot, followed by Leander, Texas.

High-Demand Location in Tennessee

There is a large need for more houses and multifamily units in Tennessee because of the large influx of people migrating from western and eastern states.

Pro Forma Highlights

Project Description

Property Name

The Woods

Property Type

Build-to-Rent Townhomes

City, State

Clarksville, TN 37040

Building Size

161,424 SF

Unit Mix

Total # of Units

120 Units

Total SF

161,424 SF

Avg. SF Per Unit

1,368 SF

Timeline and Exit

Project Acquisition

05/2022

Projected Construction Completion

05/2024

Projected Final Project Exit

05/2032

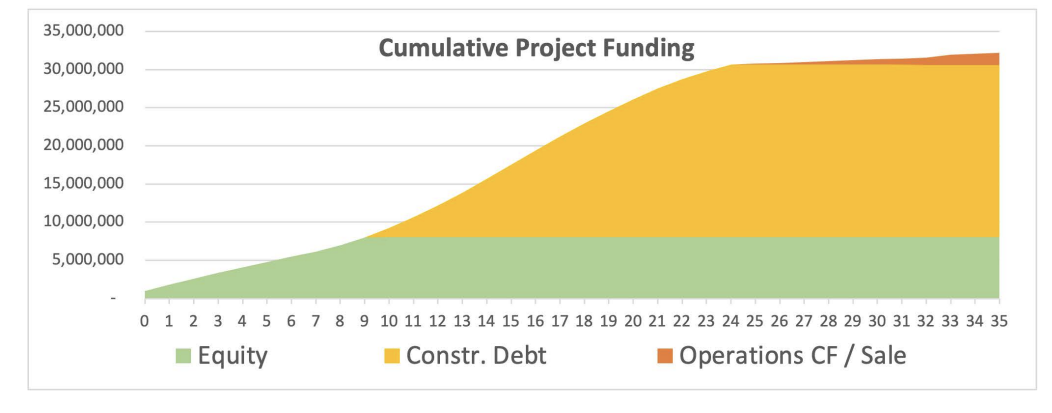

Sources

GP Equity

$402,500

Investor Equity

$7,647,887

Construction Loan

$23,015,887

Total

$31,065,887

Uses

Acquisition/Land Purchase

$1,010,000

Soft Costs

$2,085,558

Hard Costs

$26,602,361

Debt Expenses & Interest

$948,460

Reserves & Fees

-

Total Project Costs

$30,646,380

Investment Return

Investor Contributions

$7,647,500

Net Profit

$3,894,838

Projected IRR

17.03%

Multiple

1.51x

Timeline

36 Months

Site/ Floor Plans

Samaroo Group

Keith Samaroo

Keith Samaroo has over 25 years in the real estate development industry specializing in complex waterfront rezoning and brownfield redevelopment. Summary of qualifications include development, re-finance strategies and reposition for various assets; Keith was a development partner in a transit oriented multi-family development project in NY, and a development partner in a medical office building in New York. Keith was a founding member of the US Green Building Council in New York's Local Chapter, a well as serving on the board for Smart Growth Council Chapter in New York. Keith has a BS in Physics from Fordham University, and Electrical Engineering equivalent from Manhattan College and an MBA in Finance from Dowling College, New York.

Disclosures

The Woods Disclosures

© 2021 Paradyme, All Rights Reserved. Our offerings under Rule 506(c) are for accredited investors only. Neither Paradyme Funding, Inc. nor any of its other affiliates are registered investment advisors and do not provide investment advice. Paradyme Funding, Inc. and all of its affiliates do not guarantee any investment performance, outcome, or return of capital for any investment opportunity posted on the site. Investing in commercial real estate entails risk. You should not invest unless you can sustain the risk of loss of capital, including the risk of total loss of capital. This communication is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any investor. All investors should consider such factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate.